The Bourse closed on a positive note as the ASPI increased by 28.64 points (or 0.43%) to close at 6,766.14 points, while the S&P SL20 Index also increased marginally by 0.60 points (or 0.02%) to close at 3,909.54 points.

Turnover and market capitalization

Melstacorp was the highest contributor to the week’s turnover value, contributing LKR 0.57Bn or 15.68% of total turnover value.

Access Engineering followed suit, accounting for 10.73% of turnover (value of LKR 0.39Bn) while JKH contributed LKR 0.33Bn to account for 9.08% of the week’s turnover.

Total turnover value amounted to LKR 3.67Bn (cf. last week’s value of LKR 3.48Bn), while daily average turnover value amounted to LKR 0.73Bn (+5.38% W-o-W) compared to last week’s average of LKR 0.70Bn.

Market capitalization meanwhile, increased by 0.41% W-o-W (or LKR 12.55Bn) to LKR 3,068.34 Bn cf. LKR 3,055.79Bn last week.

Liquidity (in value terms)

The Diversified Sector was the highest contributor to the week’s total turnover value, accounting for 37.49% (or LKR 1.37Bn) of market turnover.

Sector turnover was driven primarily by Melstacorp, JKH, Richard Pieris & Hemas Holdings which accounted for 91.05% of the sector’s total turnover.

The Manufacturing Sector meanwhile accounted for 15.84% (or LKR 0.58Bn) of the total turnover value with turnover driven primarily by Tokyo Cement which accounted for 43.85% of the sector turnover.

The Banking, Finance & Insurance Sector was also amongst the top sectorial contributors, contributing 11.67% (or LKR 0.43Bn) to the market driven by Commercial Bank which accounted for 25.17% of the sector turnover.

Liquidity

(in volume terms)

The Diversified Sector dominated the market in terms of share volume, accounting for 36.44% (or 61.79Mn shares) of total volume, with a value contribution of LKR 1.37Bn.

The Diversified Sector dominated the market in terms of share volume, accounting for 36.44% (or 61.79Mn shares) of total volume, with a value contribution of LKR 1.37Bn.

The Banking, Finance & Insurance sector followed suit, adding 11.10% to total turnover volume as 18.83Mn shares were exchanged.

The sector’s volume accounted for LKR 0.43Bn of total market turnover value. The Manufacturing Sector meanwhile, contributed 18.78Mn shares (or 11.07%), amounting to LKR 0.58Bn.

Top gainers & losers

Madulsima was the week’s highest price gainer; increasing 33.80% W-o-W from LKR 7.10 to LKR 9.50.

Malwatta[NV] gained 28.21% W-o-W to close at LKR 5.00 while Malwatta gained 25.58% W-o-W to close at LKR 5.40. Agalawatta (+19.00% W-o-W) and Serendib Engineering Group (+18.29% W-o-W) were also amongst the gainers.

Renuka Capital was the week’s highest price loser, declining 99.02% W-o-W to close at LKR 5.40. Equity Two (-17.82% W-o-W), Lucky Lanka[NV] (-12.50% W-o-W) & Industrial Asphalts (-12.50% W-o-W) were also amongst the top losers over the week.

Foreign investors closed the week in a net buying position with total net inflows amounting to LKR 0.76Bn relative to last week’s total net inflow of LKR 0.55Bn (+37.93% W-o-W).

Total foreign purchases decreased by 3.70% W-o-W to LKR 1.98Bn from last week’s value of LKR 2.05Bn, while total foreign sales amounted to LKR 1.22Bn relative to LKR 1.50Bn recorded last week (-18.95% W-o-W). In terms of volume, Access Engineering & Richard Pieris led foreign purchases while Commercial Bank and Melstacorp led foreign sales.

In terms of value, Access Engineering and JKH led foreign purchases while Nestle and Commercial Bank led foreign sales.

Point of view

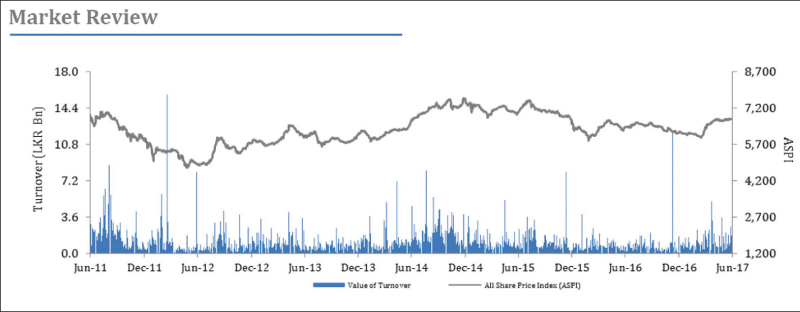

Equity markets bounced back over the week to close at an 18-month high, as the benchmark price index gained ~29 points W-o-W to end ~66 points above the key 6700 index level.

Despite a 20 point loss between Tuesday and Thursday, index gains on Monday and Friday helped pare down the losses over the week.

Markets which remained largely dull till Thursday amid thin trading, recorded average daily turnover levels of ~ LKR 0.51Bn before hitting a notable LKR 1.63Bn on Friday which helped push the average weekly turnover levels to LKR 0.73Bn (5% higher than last week’s average turnover of LKR 0.70Bn and ~19% lower than 2017 daily average turnover of LKR 0.91Bn).

Large parcels which traded on Friday led to overall crossings accounting for ~38% of the total market turnover amid strong interest in Melstacorp (37% of crossings), Access Engineering (23% of crossings) and Hemas Holdings (10% of crossings).

Foreign investors meanwhile continued to be net buyers for the 24th consecutive week to end at LKR 0.76bn despite a marginal outflow on Wednesday this week (~38% higher than last week).

Y-T-D Net Foreign flows (LKR 22.9Bn) to the Colombo Bourse thus recorded the second highest yearly inflow since 2012 (LKR 38.6Bn).

Markets in the week ahead are likely to retain the current momentum whilst looking for direction from greater clarity on the proposed new inland revenue act.

Slower pace of Fed hikes benefit FX/Bond Mkts

Emerging market equities rose to 2-year highs this week as the US Fed appeared to indicate a more gradual pace of rate hikes.

The Fed Reserve Chair’s comments to the US congress earlier in the week was interpreted by investors as ‘dovish’ and indicative of no interest rate hike in Sept’17 as US inflation rates remain below the Fed’s inflation target of 2%.

Emerging market equities and currencies responded buoyantly, as a slower pace of Fed rate hikes could impact the dollar and preserve the relatively wide gap between U.S. and developing-country bond yields.

The weaker USD along with higher interest rates in developing nations has led to record inflows to emerging-market funds in H1’17.

The US Fed’s signal of a more gradual pace of hikes is positive for Sri Lankan currency and bond markets as well as it implies that net foreign inflows to G-Secs (which have been positive since Mar’17) are likely to continue.

Net inflows to G-sec’s in Jun’17 was Rs. 236Bn vs. Rs. 196Bn in Mar’17.

Inflows to G-Secs should help support the LKR which will be vital in the context that oil imports remain high, exports relatively muted and remittances have taken a hit as geo-political tensions in the Gulf region appear to be protracted.

The US adopting a more dovish tone also implies that pressure on Sri Lanka to raise rates is lower, a positive development in light of the fact that GDP growth has slowed over Q4’16 and Q1’17.

Add new comment