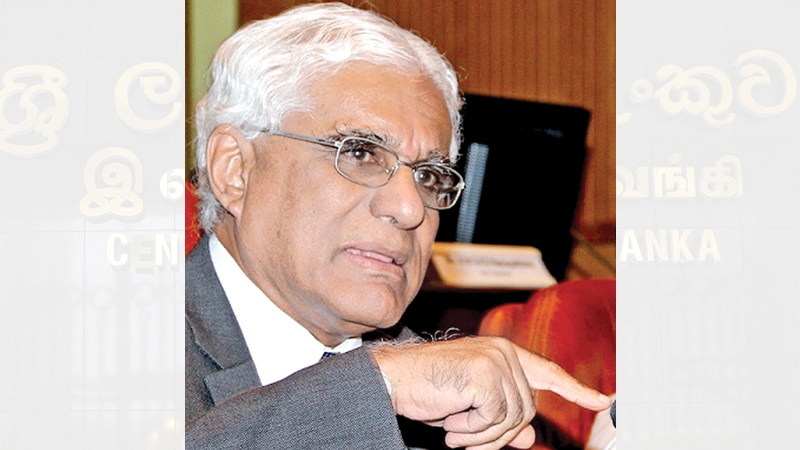

With GSP+ beginning to kick in the fourth quarter, the country’s overall annual economic growth in 2017 will be somewhere between 4% and 4.5%, Central Bank Governor Dr Indrajit Coomaraswamy said yesterday.

Addressing the monetary policy press briefing the Governor said the current account deficit will probably be 3% of the GDP and the trade deficit was running at 9% at the moment and the trade deficit at the end of this year will be about US$10 billion.

Sri Lanka has one of the very regressive tax systems in the world where by over 80% tax collection was through indirect tax.

The government is going in the right direction in terms of trying to collect more direct tax, Dr. Coomaraswamy said. The Governor envisaged that by year end, tax revenue as a percentage of GDP will be 16%.

He said the reason for inflation to reduce to 2% in the first quarter of 2016 was because they imported deflation because the prices of some imported goods came down. Now imported commodity prices have increased and that was one of the reasons apart from the increase of VAT rates that led to an increase in inflation. However, he said they expected the inflation to stabilize at 5% in the first quarter of 2018. The Governor said he would like the private sector credit growth to come down a little bit more. “It is at 18% and we would like it to come down to about 15 % by the end of the year."

He said if there was unsustainable credit growth, then clearly action would be taken to tighten monetary policy. He predicted that the budget deficit this year would be 5% of GDP.

Dr. Coomaraswamy also said that the country has reached the borrowing ceiling now and would not go for foreign capital borrowings this year.According to the current provisions of the new Inland Revenue Act, there may not be any tax levied on foreign inflows into the government securities market, he said.

The Governor said that they see an absolute decline in foreign worker remittances into the country after the rate of growth slowed down for a while. That was disturbing at one level when considering that it has been financing 70-80% of the country’s trade deficit.

However, he said in the medium term it can’t be a bad thing because the country had a very tight labour market and the ideal scenario was to see investments and FDI coming into the export sector or tradable goods sector and employing more labour. So a shift of labour from temporary migration to a growing export sector would be a positive development because it will also address some serious social problems. The Governor said the government’s policy was also to change the composition of temporary migrants.

He said that his view on smuggling rupee notes overseas was that it was illegal.

Dr. Coomaraswamy said the decision to hand over shares of state banks does not come under the purview of the Central Bank and that was a decision to be taken by the Government and that he was not aware about such a decision being made.

Add new comment