Hotels to face price competition from informal sector

Fitch Ratings expects Sri Lanka’s hotels sector to face price competition from the growing informal sector and alternative accommodation models.

Fitch says that EBITDA margins (measures the extent to which cash operating expenses use up revenue) could also be squeezed by the expanding marketing budgets of hotel operators.

The margins of listed hotel operators considered in our analysis have softened by around 100bp over the last two years, to 28%, as most operators hold back on passing cost escalations to customers due to the prevalence of low cost competition.

“We expect this trend to continue over the medium term, and cause margins to compress by 200bp–300bp over the next two to three years.”

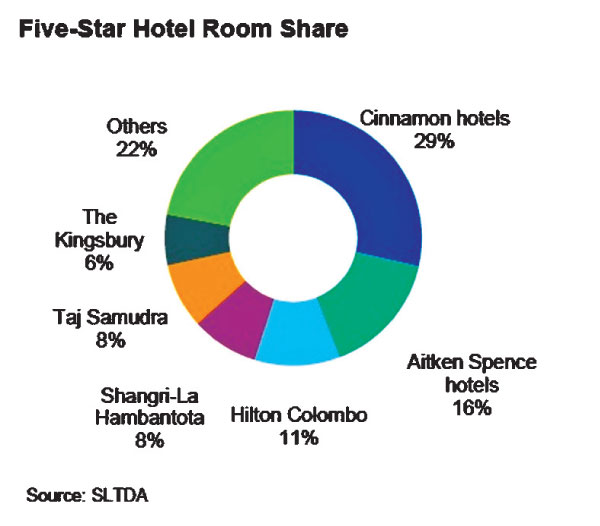

Demand for rooms of listed hotel operators has been sufficient to drive an increase in average room rate (ARR) to USD87 from USD70 between 2014 and 2016, while occupancy stabilised at around 75% during the same period. Fitch believes that the 11,645 rooms that the Sri Lanka Tourism Development Authority (SLTDA) expects to come online by end-2018, will support medium-term demand. However, a likely glut in residential apartments and informal accommodation establishments will keep formal-sector occupancy pressured.

The median credit metrics for listed hotel operators have remained largely stable over the last four years – with gross leverage (gross debt/EBITDA) averaging 2.2x in the last reported financial year end.

Fitch expects this ratio to increase with the respective renovation pipelines of industry operators, but to stabilise at between 3.0x to 3.5x over the medium term. “We also expect the large established operators to remain free cash flow (FCF) positive over the next two years as most will already have concluded their renovation cycles.”

|

| Cinammon Lakeside |

The Two large listed hotel companies, John Keells Hotels and Asian Hotels & Properties, which are both part of John Keells Holdings PLC, benefit from much lower net leverage than other listed peers.

Star-graded accommodation in the capital, Colombo, costs 10%-15% more than regional competition, owing partly to the regulatory price floor but also to relatively high costs of construction, energy and imports. Fitch believes this will lead some tourists to choose cheaper destinations or lodging options.

Fitch considers the shortage of skilled human resources a key issue, given the surge in the number of hospitality establishments driving up demand for a trained workforce. Employment in the industry recorded a CAGR of 9.8% over the last 10 years against a 17.1% growth in tourist arrivals.

“We expect the hotel schools run by some leading hospitality brands, and a growing number of hotel-management courses offered by private-sector education providers, to mitigate this risk.”

“We believe that the available registered room capacity as of end-2016 plus the 11,645 rooms that will be added by end-2018 will be adequate to meet room demand over the medium term.

However the likely increase in luxury and semi-luxury residential apartments and other unregistered accommodation establishments will put pressure on the formal sector’s EBITDA margins.”

Fitch believes that Sri Lankan city hotels could lose their attractiveness because of their relatively higher room rates owing to steep cost structures. The higher accommodation costs especially star-graded facilities are due mainly to the prevalence of minimum room rate regulation, higher cost of construction and energy tariffs.

The average per night price of a room in five-star graded establishments in Colombo exceeds USD180 (with taxes), compared with similar accommodation units in Bangkok (USD175), Kuala Lumpur (USD165), Chennai (USD130) and Mumbai (USD168).

Add new comment