HNB successfully weathered the challenges that arose in 2017 while leveraging upon new growth opportunities to post a profit after tax (PAT) of Rs 16.5 Bn reflecting growth of 16.4% Year-on-Year (YoY). Group PAT improved to Rs 16.7 Bn while the Group’s asset base crossed the Rs 1 trillion milestone, during the year.

In 2017 HNB was recognized domestically and internationally for its outstanding performance and was crowned the ‘Best Bank in Sri Lanka’ by the coveted Banker Magazine UK.

CASA growth of Rs 23.4 Bn during the year was a key achievement given the industry wide decline in CASA ratios as high interest rates attracted funds into fixed deposits. Nevertheless through concerted efforts HNB successfully maintained its CASA ratio while focusing on profitable business segments. As a result the Bank’s Net Interest Margins (NIM) increased from 4.80% in 2016 to 4.87% in 2017.

The bank’s Fee & Commission income grew by 18% YoY in 2017, strongly supported by rapid growth in digital payments and channels in addition to the growth in Trade Finance.

HNB’s profit before taxes and financial VAT was reported at Rs 27.1 Bn amounting to growth of 10.5% YoY while total tax charge for the Bank and the group stood at Rs 10.6 Bn and Rs 11.8 Bn respectively. The Bank’s ROA remained at 1.8% while the ROE declined to 17.8% for 2017 due to the increase in equity through the rights issue.

Meanwhile, HNB’s total assets grew by 11.2% YoY to Rs 954.9 Bn while loans and advances grew by 9.4% YoY to Rs 639 Bn. The Bank consciously maintained low growth in advances in order to focus on profitable balance sheet growth and portfolio quality. HNB’s deposit base grew by 12.5% YoY and exceeded the Rs 700 Bn mark with the Bank’s CASA growth of 10.4% YoY outpacing industry average.

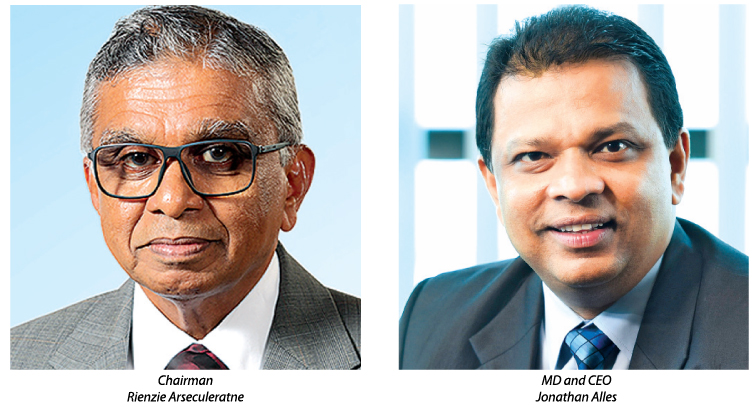

Commenting on HNB’s performance, MD/CEO Jonathan Alles said: “HNB’s performance in 2017 has been strong and resilient amidst relatively low economic growth and a tighter fiscal and monetary policy environment.

“Our proven business model and strategy centered on digital leadership, best in class processes, and an uncompromising stance on being the best service brand in the country has once again been validated in 2017.”

All group companies reported profits during the period in review, and contributed towards a total group PAT of Rs 16.7 Bn which reflected growth of 6.9% YoY.

Group ROA and ROE were recorded at 1.75% and 14.95% respectively.

Add new comment