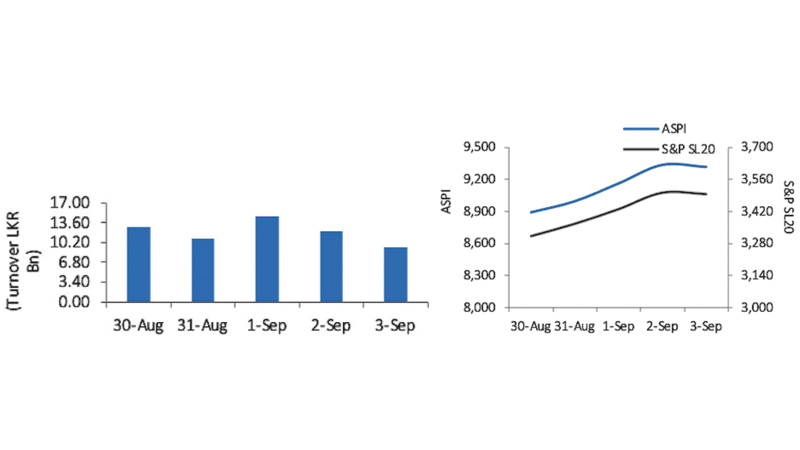

The Bourse ended the week on a positive note this week with ASPI increasing by 385.32 points (or 4.31%) to close at 9,316.65 points, while the S&P SL20 Index also increased by 149.51 points (or 4.47%) to close at 3,494.76 points.

Expolanka was the highest contributor to the week’s turnover value, contributing LKR 15.64Bn or 26.17% of total turnover value. Browns Investments followed suit, accounting for 22.12% of turnover (value of LKR 13.22Bn) while L O L C Holdings contributed LKR 3.35Bn to account for 5.60% of the week’s turnover.

Total turnover value amounted to LKR 59.75 Bn (cf. last week’s value of LKR 55.05 Bn), while the daily average turnover value amounted to LKR 11.95Bn (8.54% W-o-W) compared to last week’s average of LKR 11.01Bn. Market capitalization meanwhile, increased by 4.31% W-o-W (or LKR 171.70 Bn) to LKR 4,151.63 Bn cf. LKR 3,979.93 Bn last week.

Liquidity (Value & Volume)

Transportation Industry Group was the highest contributor to the week’s total turnover value, accounting for 26.27% (or LKR 15.70Bn) of market turnover. Industry Group’s turnover was driven primarily by Expolanka which accounted for 99.62% of the sector’s total turnover. Food Beverage & Tobacco Industry Group meanwhile accounted for 24.79% of the total turnover value while Capital Goods Industry Group contributed 21.32% to the weekly turnover.

The Food Beverage & Tobacco Industry Group dominated the market in terms of share volume, accounting for 49.27% (or 1,263.96 Mn shares) of total volume, with a value contribution of LKR 14.81Bn. The Diversified Financials Industry Group followed suit, adding 20.04% to total volume (514.14 Mn shares) while Capital Goods Industry Group contributed 9.95% (255.35 Mn shares) to the weekly share volume.

Dividend Announcements

Company, DPS (Rs.), Dividend Type, Date (XD); ABANS ELECTRICALS PLC, 3, First and Final dividend, 30/09/2021.

Key Economic Indicators August; Prime Lending Rate-5.85%; Ave. Wtd. Deposit Rates-4.75%; Ave. Wtd. Fixed Dep. Rates-5.62%; CCPI Inflation Y-o-Y %-6%.

Net Foreign Position

Foreign investors were net sellers this week with a total net outflow amounting to LKR 3.38 Bn relative to last week’s total net outflow of LKR 0.60 Bn (-461.80% W-o-W).

Total foreign purchases increased by 2.20% W-o-W to LKR 0.49Bn from last week’s value of LKR 0.48Bn, while total foreign sales amounted to LKR 3.87Bn relative to LKR 1.08Bn recorded last week (257.7% W-o-W)

Add new comment