The Bourse ended the week on a positive note this week with ASPI increasing by 538.96 points (or 5.06%) to close at 11,197.68 points, while the S&P SL20 Index also increased by 148.03 points (or 4.03%) to close at 3,822.61 points.

Browns Investments was the highest contributor to the week’s turnover value, contributing LKR 6.24Bn or 15.82% of total turnover value. LOLC Finance followed suit, accounting for 10.11% of turnover (value of LKR 3.99Bn) while Expolanka contributed LKR 3.47Bn to account for 8.80% of the week’s turnover.

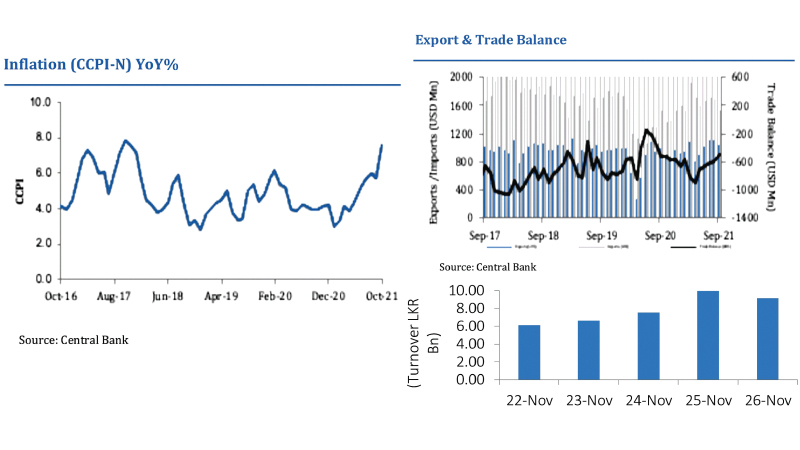

Total turnover value amounted to LKR 39.46 Bn (cf. last week’s value of LKR 36.83 Bn), while the daily average turnover value amounted to LKR 7.89 Bn (-14.30% W-oW) compared to last week’s average of LKR 9.21 Bn. Market capitalization meanwhile, increased by 5.06% W-o-W (or LKR 240.57 Bn) to LKR 4,997.35 Bn cf. LKR 4,756.78 Bn last week.

Liquidity (Value & Volume)

Food Beverage & Tobacco Industry Group was the highest contributor to the week’s total turnover value, accounting for 28.12% (or LKR 11.09Bn) of market turnover. Industry Group’s turnover was driven primarily by Browns Investments, Sunshine Holding and Agalawatte which accounted for 79.10% of the sector’s total turnover.

Capital Goods Industry Group meanwhile accounted for 19.28% of the total turnover value while Diversified Financials Industry Group contributed 18.87% to the weekly turnover.

The Food Beverage & Tobacco Industry Group dominated the market in terms of share volume, accounting for 43.34% (or 672.34 Mn shares) of total volume, with a value contribution of LKR 11.09Bn. The Diversified Financials Industry Group followed suit, adding 18.41% to total volume (285.56 Mn shares) while Materials Industry Group contributed 11.45% (177.70 Mn shares) to the weekly share volume.

Net Foreign Position

Foreign investors were net sellers this week with a total net outflow amounting to LKR 1.53 Bn relative to last week’s total net outflow of LKR 1.44 Bn (-6.1% W-o-W). Total foreign purchases decreased by 32.4% W-o-W to LKR 0.38Bn from last week’s value of LKR 0.56Bn, while total foreign salesamounted to LKR 1.91Bn relative to LKR 2.00Bn recorded last week (-4.8% W-o-W).

Add new comment