The 55 “Strategically Important” listed State-Owned Enterprises (SOE) snowballing losses from 2006 to 2020 is a staggering Rs. 1.2 trillion. Out of the 527 state-owned enterprises the Treasury has classified 55 as “Strategically Important” it was revealed at an Advocata Institute that organised an event on “The Urgency of State-Owned Enterprise Reforms” last week.

Sri Lanka’s State-Owned Enterprises have placed a significant burden on public finances. They are also a major source of inefficiency in the economy. “Therefore the present economic crisis, along with Sri Lanka’s current debt crisis, makes reforms on SOE’s a national priority to emerge from present economic challenges,” it was opined at the event.

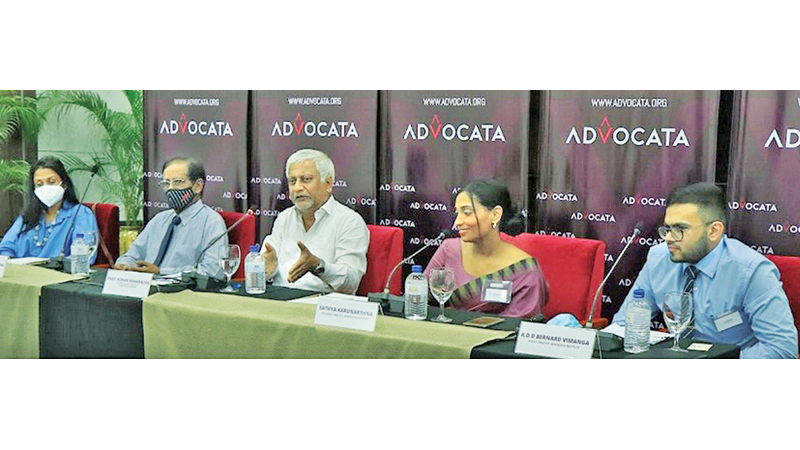

Policy Analyst Advocata, K.D.D.B.Vimanga said that Ceylon Petroleum Corporation, Ceylon Electoral Board, SriLankan Airlines, and Sri Lanka Transport Board daily loss in the year 2019 per day was Rs. 384,479,189. Academic Chair Advocata Institute Dr Sarath Rajapatirana, said that the total productivity of SOE is less than 1% and very much less in countries like Vietnam and Korea.

LIRNEasia Founding Chair and Advocata Institute Advisor Prof. Rohan Samarajiva for the second time in succession (at an Advocate event) stressed that SriLankan Airlines should be privatised as it is making around Rs. 47 billion in losses per annum. “What is the rationality of using public funds collected through commodity taxes from persons who have never even gone near the airport to keep this airline,” he asked. He also pointed out that even India doesn’t own a national carrier as (Air India was returned to Tata after 68 years. After the Group paid INR 18,000 crore to acquire it from the government.)

“Currently Sri Lanka lacks credibility to approach our creditors. Therefore, the privatisation of SriLankan Airlines represents a grand gesture to alter the existing perception regarding Sri Lanka’s sincerity in meeting its debt obligations and will go a long way in improving our credibility,” claimed Prof. Samarajiva.

He also cited Sri Lanka Telecom as one of the success stories of privatization for which credit should go to former Minister Mangala Samaraweera.

After the liberalization, SOE’s productivity jumped up but they could not maintain it. He also said that some SOE’s like Steel Corporation should not have been started. “SOEs which are less productive surprisingly have staff five times bigger than John Keells Holdings!”

He also said that the government always comes to the rescue of the SOE by pumping money to it by way of providing handouts which are termed as ‘letters of comfort.”

Director, John Keells Hotels and Deputy CEO, Sri Lanka at Lankan Angel Pvt. Ltd, Anarkali Moonesinghe called for looking at the privatization of some of the SOEs by way of listing in the Stock Market. She noted that there were sizable large capital-based companies that would benefit through broad basing of their ownership.

“Sri Lanka Insurance (SLIC) poses a great opportunity to list along with some of its subsidiary entities. Even the state-owned banks could consider this as it would drive and fundamentally change our stock market. This is not easy as these SOE’s have to be corporatized and made better disciplined.”

She added, “For all this, a powerful regulator is needed.”

Add new comment