The Bourse ended the week on a negative note this week as the ASPI decreased by 17.91 points (or -0.30%) to close at 5,964.14 points, while the S&P SL20 Index also decreased by 14.39 points (or -0.47%) to close at 3,058.07 points.

The Bourse ended the week on a negative note this week as the ASPI decreased by 17.91 points (or -0.30%) to close at 5,964.14 points, while the S&P SL20 Index also decreased by 14.39 points (or -0.47%) to close at 3,058.07 points.

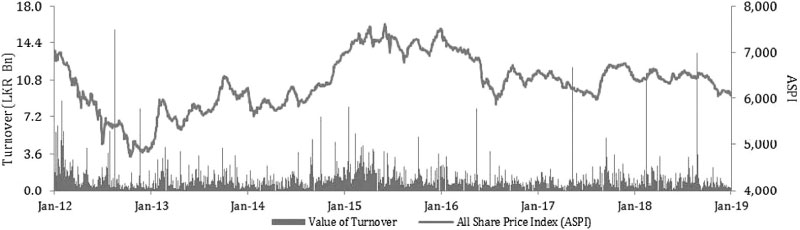

Turnover & Market Capitalization

JKH was the highest contributor to the week’s turnover value, contributing LKR 1.03Bn or 53.45% of total turnover value. HNB followed suit, accounting for 8.11% of turnover (value of LKR 0.16Bn) while Sampath Bank contributed LKR 0.10Bn to account for 5.26% of the week’s turnover. Total turnover value amounted to LKR 1.92Bn (cf. last week’s value of LKR 3.30Bn), while daily average turnover value amounted to LKR 0.48Bn (-27.10% W-o-W) compared to last week’s average of LKR 0.66Bn. Market capitalization meanwhile, decreased by 0.30% W-o-W (or LKR 8.32Bn) to LKR 2,787.41Bn cf. LKR 2,795.73Bn last week.

Liquidity (in Value Terms)

The Diversified sector was the highest contributor to the week’s total turnover value, accounting for 56.48% (or LKR 1.09Bn) of market turnover. Sector turnover was driven primarily by JKH which accounted for 94.63% of the sector’s total turnover. The Banks, Finance & Insurance sector meanwhile accounted for 30.02% (or LKR 0.58Bn) of the total turnover value, with turnover driven primarily by HNB, Sampath Bank, Ceylinco Ins., Union Bank, Commercial Bank V & NV which accounted for 85.42% of the sector turnover. The Manufacturing sector was also amongst the top sectorial contributors, contributing 6.38%(or LKR 0.12) of the total turnover, where sector turnover was primarily driven by Teejay Lanka which accounted for 70.27% of the sector turnover.

Liquidity (in Volume Term

The Banks, Finance & Insurance sector dominated the market in terms of share volume, accounting for 34.96% (or 14.33Mn shares) of total volume, with a value contribution of LKR 0.58Bn. The Diversified sector followed suit, adding 28.10% to total turnover volume as 11.52Mn shares were exchanged. The sector’s volume accounted for LKR 1.09Bn of total market turnover value. The Manufacturing sector meanwhile, contributed 3.99Mn shares (or 9.74%), amounting to LKR 0.12Bn.

Top Gainers & Losers

Asia Asset was the week’s highest price gainer; increasing 766.7% W-o-W from LKR0.90 to LKR7.80 while Blue Diamonds (+20.0% W-o-W), Chemanex (+13.9% W-o-W) and Serendib Hotels[X](+11.6% W-o-W) were also amongst the top gainers.

The Finance Co. [X] were the week’s highest price loser; declining 40.0% W-o-W to close at LKR0.60 while Office Equipment (-22.4% W-o-W), Tess Agro (-20.0% W-o-W) and Nation Lanka (-14.3% W-o-W) were also amongst the top losers over the week.

Foreign investors closed the week in a net selling position with total net outflow amounting to LKR 0.90Bn relative to last week’s total net outflow of LKR 0.41Bn (-247.9% W-o-W). Total foreign purchases decreased by 75.7% W-o-W to LKR 0.26Bn from last week’s value of LKR 1.07Bn, while total foreign sales amounted to LKR 1.16Bn relative to LKR 1.49Bn recorded last week (-21.8% W-o-W). In terms of volume, Teejay Lanka & Merchant Bank led foreign purchases while JKH & Expolanka led foreign sales. In terms of value, Teejay Lanka & Vallibel Finance led foreign purchases while JKH & Hemas Holdings led foreign sales.

Point of View

Wednesday to hit a 2-week low of 5,957.41 as markets reversed last week’s marginal W-o-W gain (of 3.8 points). Although the Broad-share index managed to recover some of the week’s early losses during the latter half of the week, the gains remained paltry (~6.7 index points) and failed to offset the ~25 point loss the Index experienced between Monday and Wednesday. The benchmark ASPI consequently ended the week at 5,964.14, to represent an ~18 point drop from last week’s close.

The losses on the Index was broadly in line with that of most Emerging and Frontier market peers, who also posted weekly losses for the first time in seven weeks amid concerns of slowing global growth and the lack of any positive signs for a resolution between the US-China regarding its trade row. Activity levels on the Colombo Bourse during the holiday shortened week was also weak, and daily average turnover levels dropped 27% W-o-W to average at Rs. 0.48Bn (from Rs. 0.66Bn last week), well below the annual average of Rs. 0.57Bn.

However, some buying interest by Local HNI and Institutional investors was present during the week, and several crossings were registered in heavyweight JKH (62% of total crossings) and in certain counters within the banking & insurance sector (38% of total crossings). Local HNI and Institutional investors consequently accounted for 48% of the week’s total market activity. Foreign buying interest meanwhile remained subdued during the week, decreasing to Rs. 0.26Bn (cf. Rs. 1.07Bn last week) and translating to a net foreign outflow of Rs.0.90Bn over the week. The YTD sell-off on domestic equities consequently increased to Rs. 3.39Bn (cf. net inflow of Rs. 4.04Bn in the first 5-weeks of 2018). Markets in the week ahead are likely to look for cues from ongoing corporate earnings releases.

Fears of Weak Demand & Oversupply Impact Oil

The rebound in global oil prices since late December appeared to slow this week, as Brent crude oil prices dropped 2% from its 2019 high of $62.75/bbl over the week. The nearly 2-year bull-run (since Jun’2017) in global commodities stalled late last year amid concerns over global economic growth and rising U.S. supplies, and Brent crude oil prices (which had hit a 15-month high of $86.29/bbl in Oct’18) crashed 42% to $50.47/bbl by Dec 24 2018.

However, Crude oil prices subsequently rebounded, and crude oil prices have since gained 20%, hitting a high of $62.75/bbl on Feb 1 as investors shrugged off concerns over China’s slowing growth and focused instead on positive supply side drivers for the market. This week however, concerns over slowing demand and rising supplies converged, causing Brent crude oil prices to fall from their February high of $62.75/bbl to $61.28/bbl.

Markets were rattled by China reporting its lowest annual economic growth in nearly 30 years, and the ongoing impasse in U.S.-China negotiations to end the trade war between the world’s main two economies have heightened concerns that crude oil demand would be insufficient to absorb growing crude production. Markets remain concerned that OPEC oil producers may not strictly adhere to the production cuts they had agreed to last year, and the US EIA’s data which showed an increase in US Crude oil inventories worried investors that the positive supply side dynamics which were driving the oil market rally thus far were waning. So far this year, Brent Crude oil prices have risen 12% (this week’s losses pared down the Jan’19 gain of 14%) but Analysts expect commodity prices to largely stabilize in 2019 due to concerns about the effects of tariffs on global growth and trade.

Add new comment